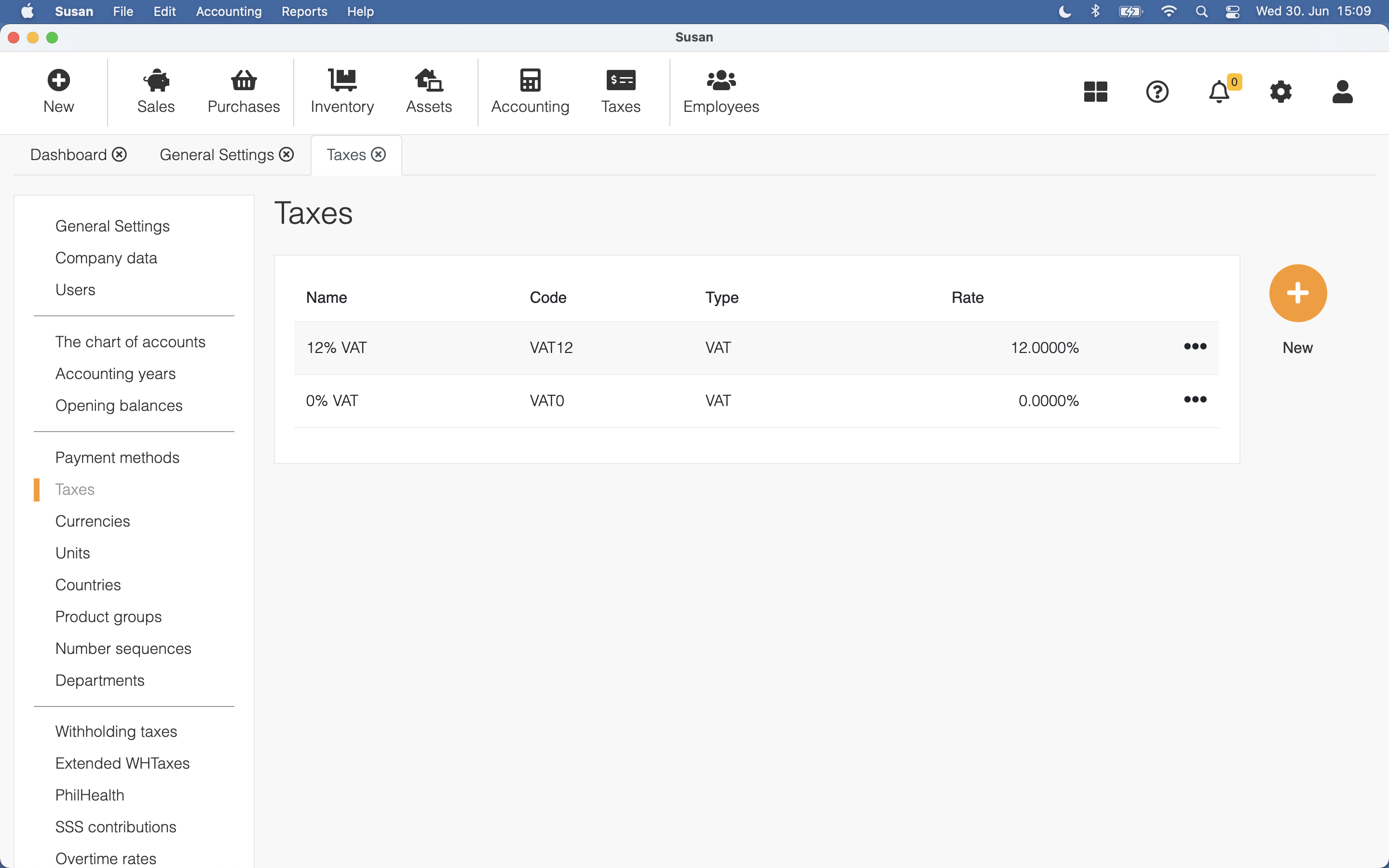

Susan.one > Configuration > Taxes

Taxes

Overview

During the initial setup, Susan.one will add your country based VAT rates automatically.

To review all taxes, navigate to Settings > Taxes. Once there, you’ll see a list view of all available taxes.

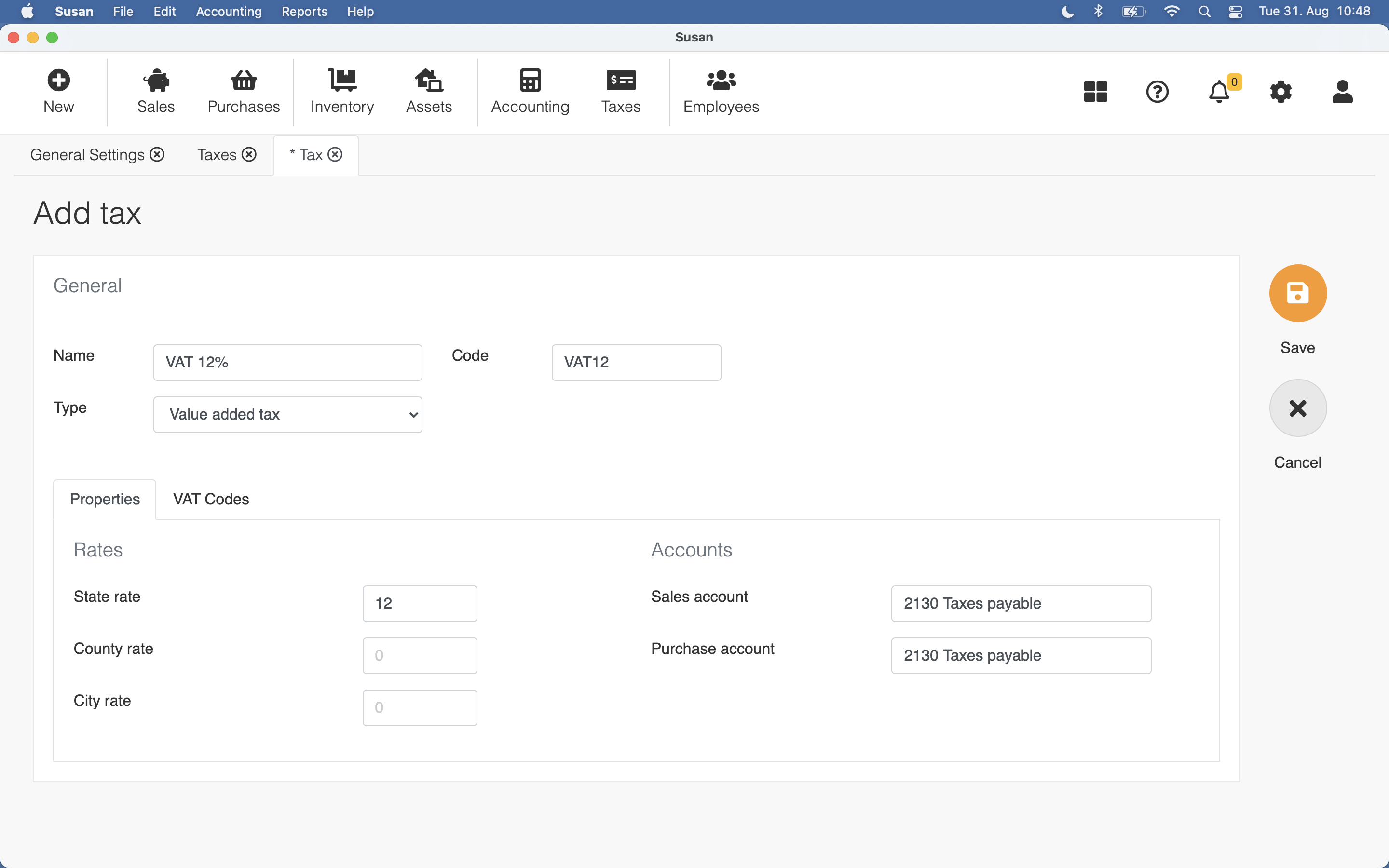

Adding a New Tax

To add a tax, follow these steps:

- Open the taxes list

- Click New

- Fill the following fields:

- name - tax name

- code - tax code

- type - tax type (value added tax, corporate income tax etc.)

- state rate - state share as a percentage of the tax

- county rate - county share as a percentage of the tax

- city rate - city share as a percentage of the tax

- sales account - which account is used for the sale

- purchase account - which account is used for the purchase

- Click Save

Tax total rate is the sum of state, county, and city rates

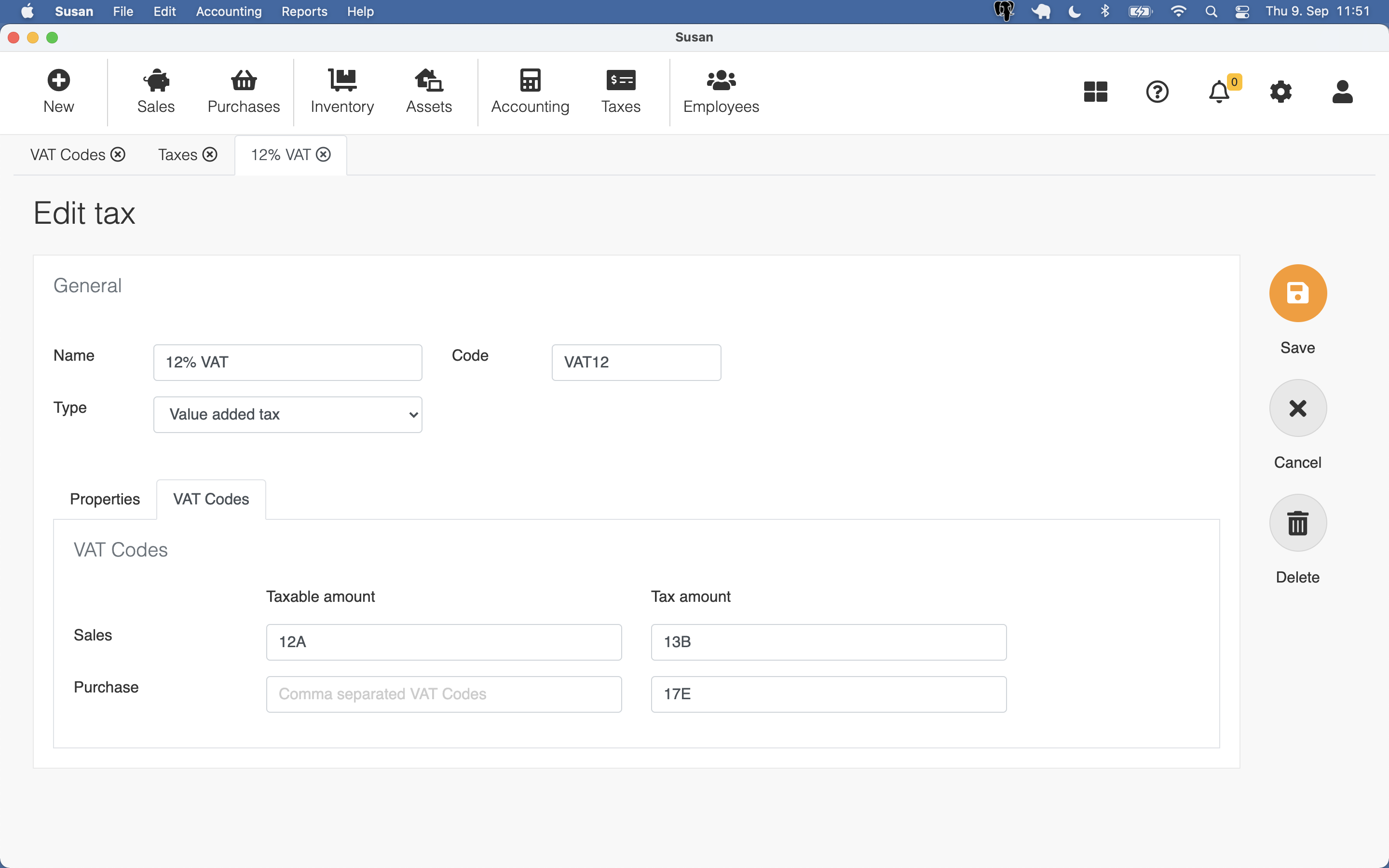

When the tax is VAT, you can define on which row(s) VAT is included in the Value-Added Tax declaration. Insert comma-separated VAT codes to sale and purchase fields.

Editing tax

To edit the tax, follow these steps:

- Click on the tax in the taxes list view

- Edit the tax fields

- Click Save

Deleting tax

To delete the tax, follow these steps:

- Click on the tax in the taxes list view

- Click Delete

- Click Confirm on the confirmation dialog

The tax rate used either on the documents or elsewhere cannot be deleted