VAT Codes

Overview

- Adding a VAT code

- Editing VAT code

- Deleting VAT code

- Restoring default VAT codes

- Applying VAT code to VAT

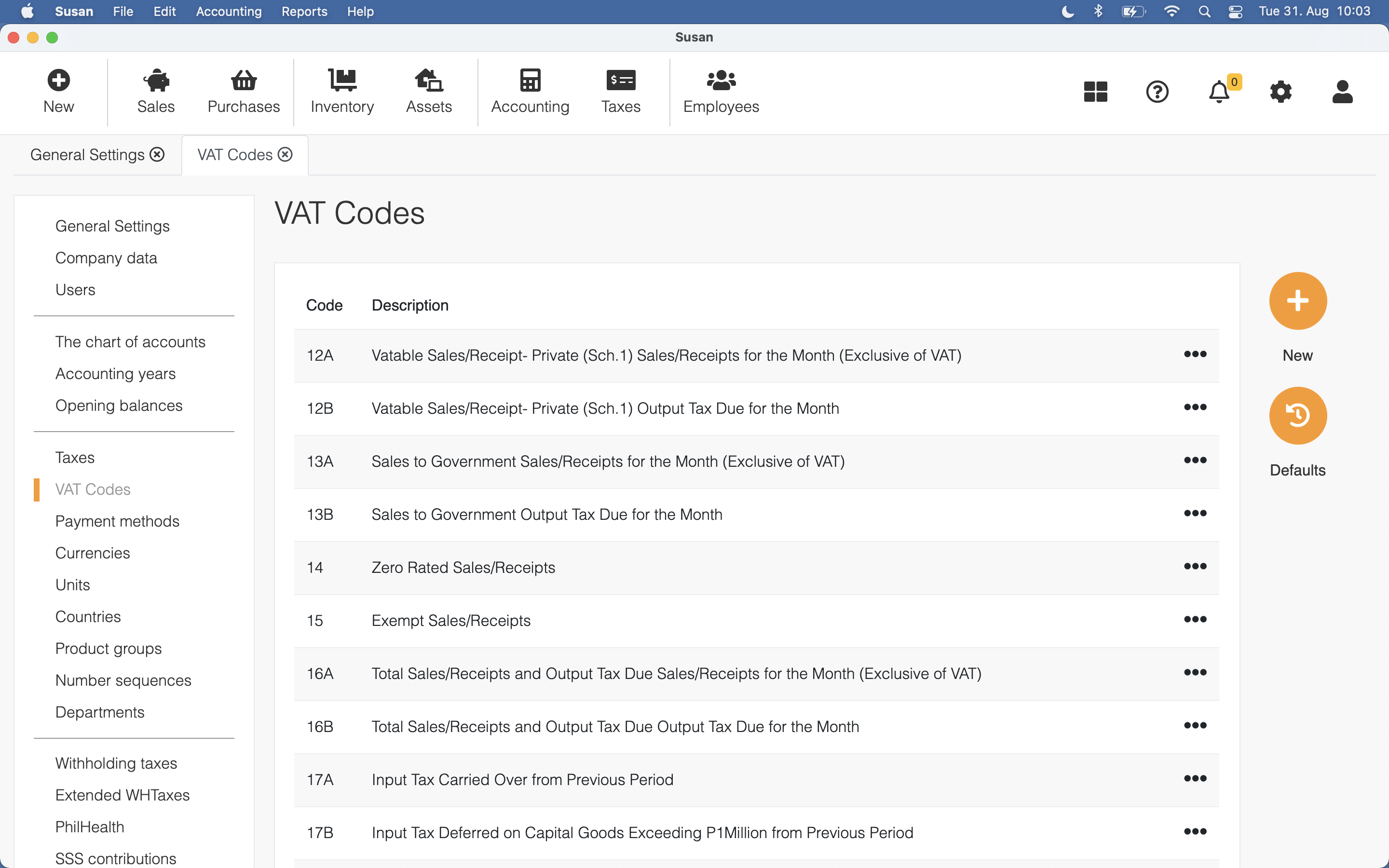

VAT codes in Susan are monthly Value-Added Tax declaration rows, which can be linked to VAT. During the initial setup, Susan.one will add your country based VAT codes automatically.

To review all VAT codes, navigate to Settings > VAT Codes. Once there, you’ll see a list view of all available VAT codes.

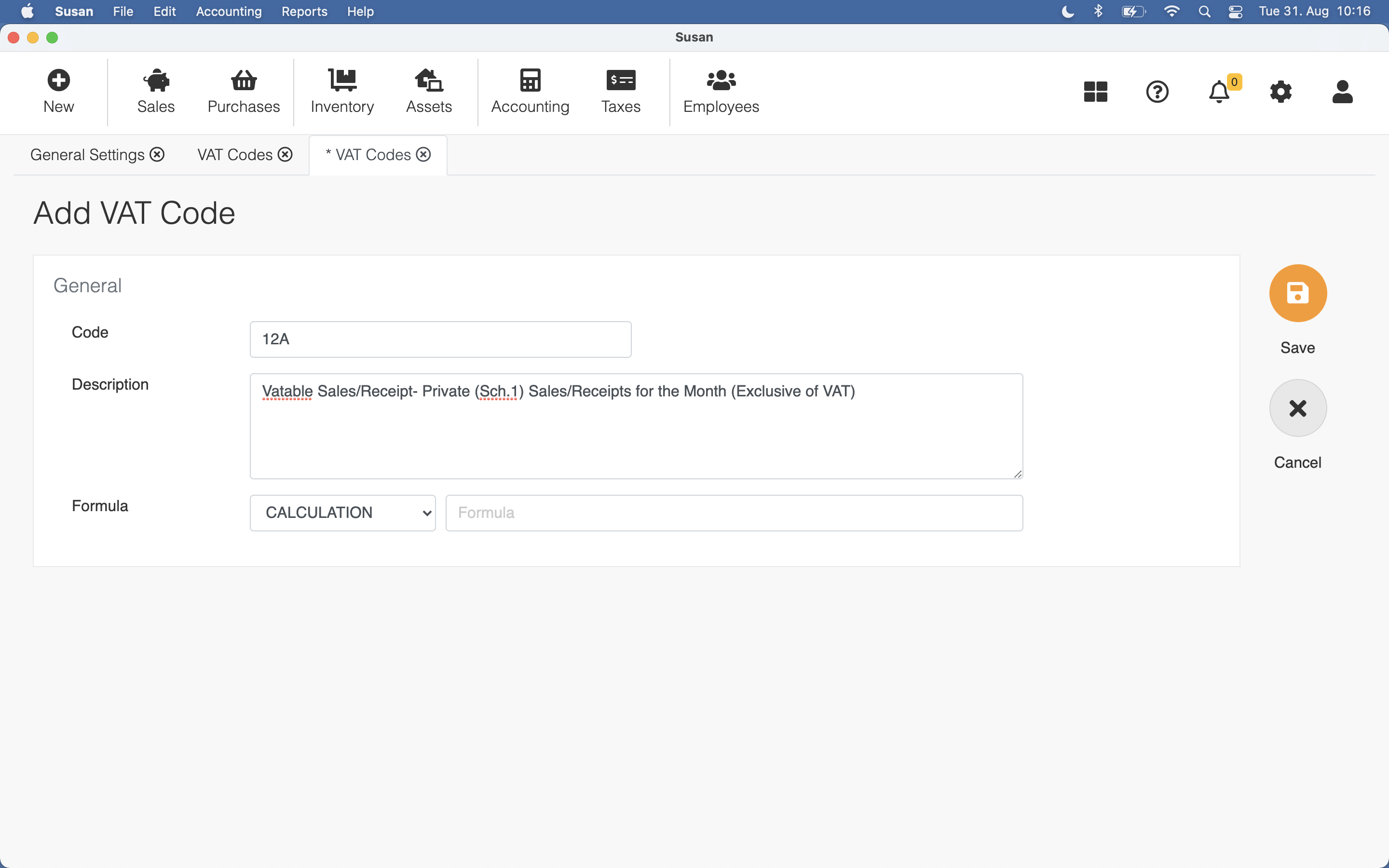

Adding a VAT Code

To add a VAT code, follow these steps:

- Open the VAT codes list

- Click New

- Fill the following fields:

- code - VAT code (row number)

- description - description of the VAT code

- formula - formula when row result is calculation of rows

- Click Save

Formula

Every formula has a type, which can be:

- CALCULATION - returns calculation result

- IF POSITIVE - returns calculation result if the result is positive

- IF NEGATIVE - returns calculation result as a positive number if the result is negative

Formula supports four basic math operations: addition (+), subtraction (-), multiplication (*) and division (/). For example, if the result is the sum of codes A1 and B1, the formula is described as follows: A1+B1.

The formula is validated before it can be applied to the VAT code

Editing VAT code

To edit the VAT code, follow these steps:

- Click on the VAT code in the VAT codes list view

- Edit the VAT code fields

- Click Save

Deleting VAT code

To delete the VAT code, follow these steps:

- Click on the VAT code in the VAT codes list view

- Click Delete

- Click Confirm on the confirmation dialog

Restoring default VAT codes

In case, when you have deleted or changed VAT codes added during installation and you need to restore the initial state, follow these steps:

- Open the VAT codes list

- Click Defaults

Applying VAT code to VAT

Please look at Adding a new tax