Fixed Assets

Overview

A fixed asset is a long-term tangible piece of property or equipment (such as land, buildings, and equipment) that a firm owns and uses in its operations to generate income. Fixed assets are not expected to be consumed or converted into cash within a year.

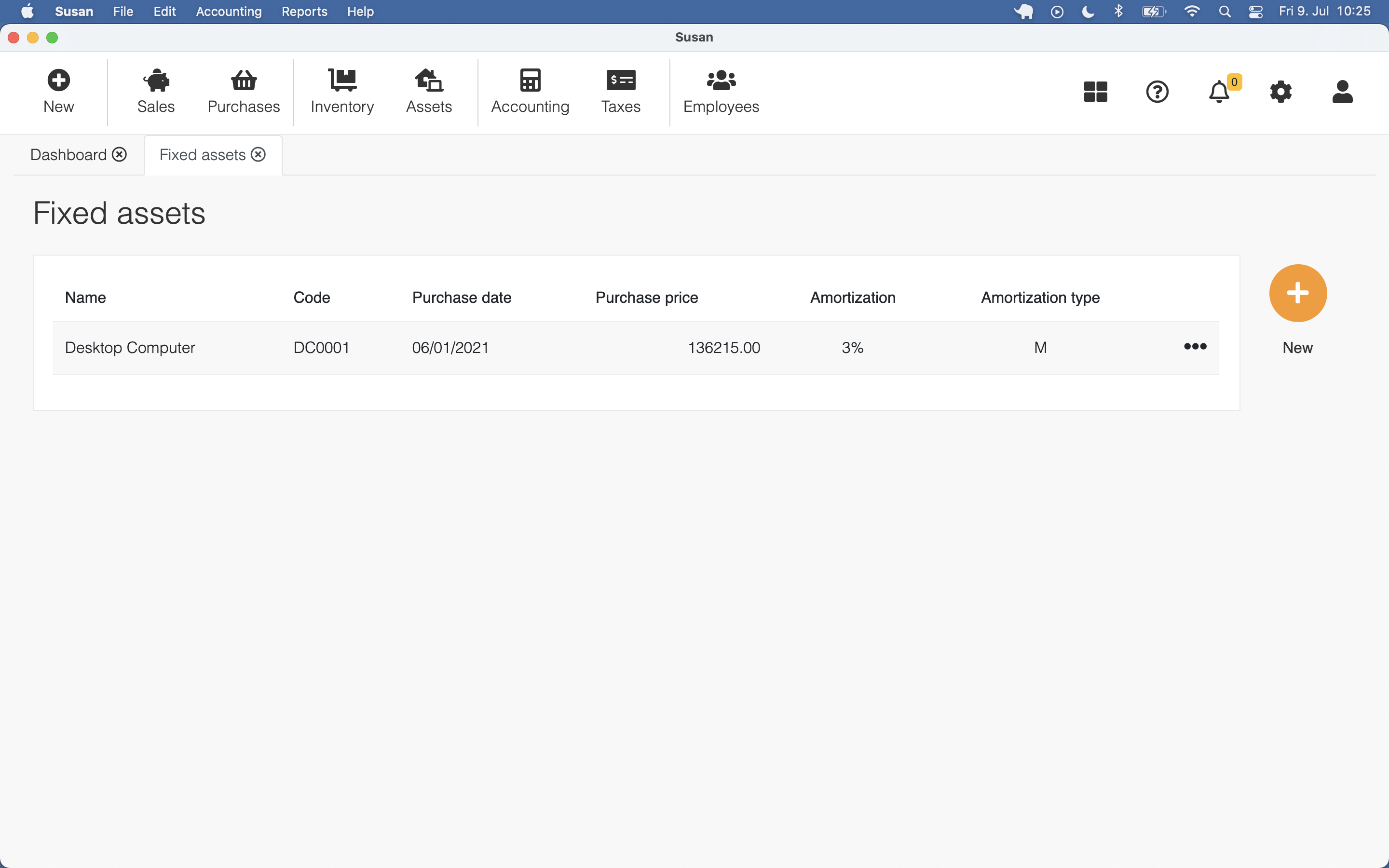

To review your fixed assets, navigate to Assets > Fixed Assets. Once there, you’ll see a list view of all fixed assets.

Adding Fixed Asset

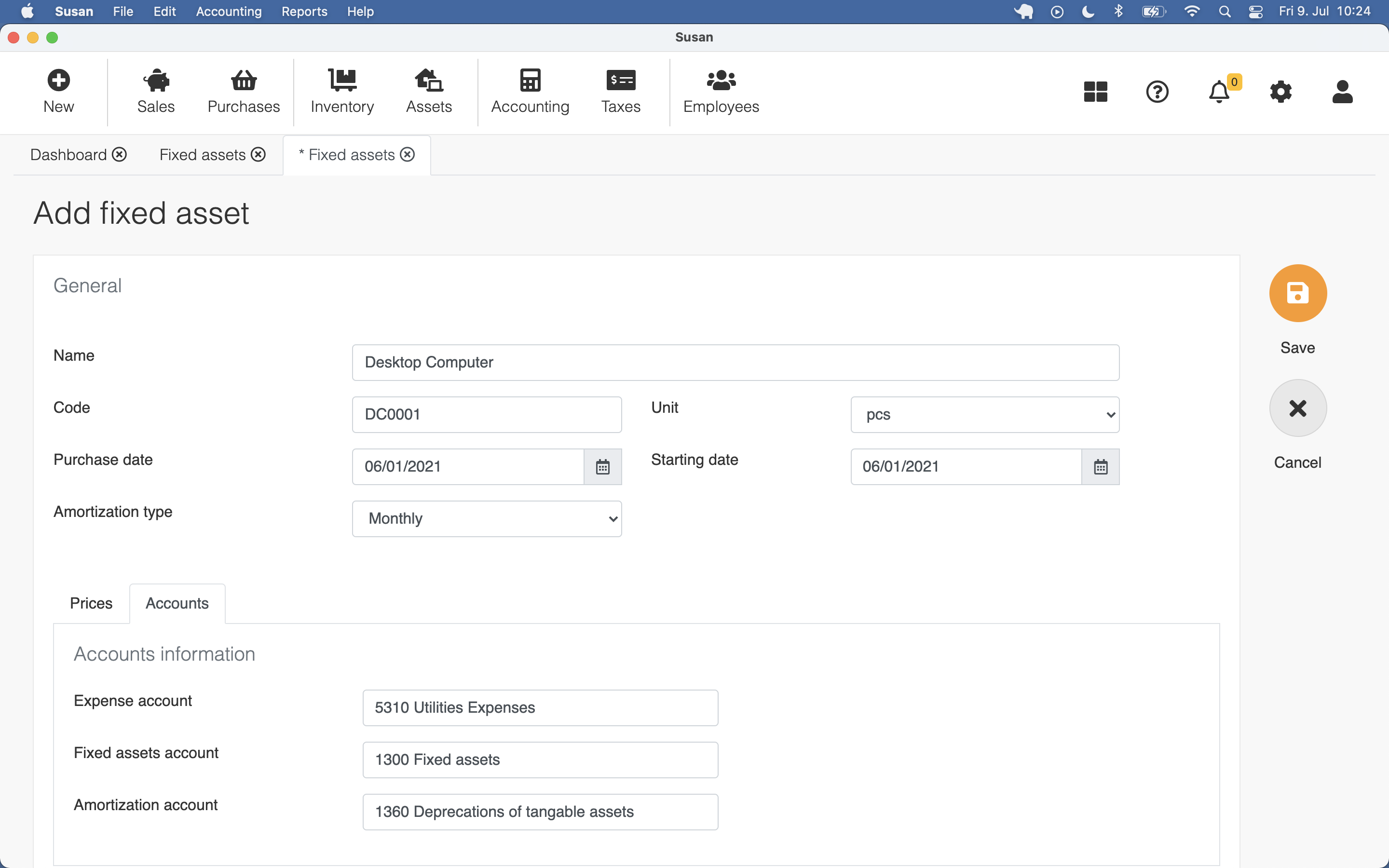

To add a fixed asset, follow these steps:

- Open the fixed assets list

- Click New

- Fill the fixed assets card

- Click Save

There is a lot of details you can insert into the fixed asset.

| Field | Required | Description |

|---|---|---|

| name | MANDATORY | Asset name |

| code | MANDATORY | Asset code |

| unit | OPTIONAL | Asset unit |

| purchase date | MANDATORY | The day when asset was purchased |

| starting date | MANDATORY | The day when depreciation begins |

| amortization type | MANDATORY | Monthly, quarterly, yearly |

| purchase price | OPTIONAL | Asset purchase price |

| starting price | OPTIONAL | The starting price from which depreciation will be calculated |

| amortization percentage | MANDATORY | The amount of depreciation as a percentage over a specified period |

| expense account | MANDATORY | Account used for expense |

| fixed assets account | MANDATORY | Account used for fixed assets |

| amortization account | MANDATORY | Account used for amortization |

Editing Fixed Asset

To edit the fixed asset, follow these steps:

- Open the fixed assets list and click on the asset

- Edit the fixed assets data

- Click Save

Deleting Fixed Asset

To delete the fixed asset, follow these steps:

- Open the fixed assets list and click on the asset

- Click Delete

- Click Confirm on the confirmation dialog