Payroll Deductions

Overview

- Deduction types

- Adding payroll deduction

- Editing payroll deduction

- Deleting payroll deduction

- Deductions report

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes or certain services. Payroll deduction may be voluntary or involuntary.

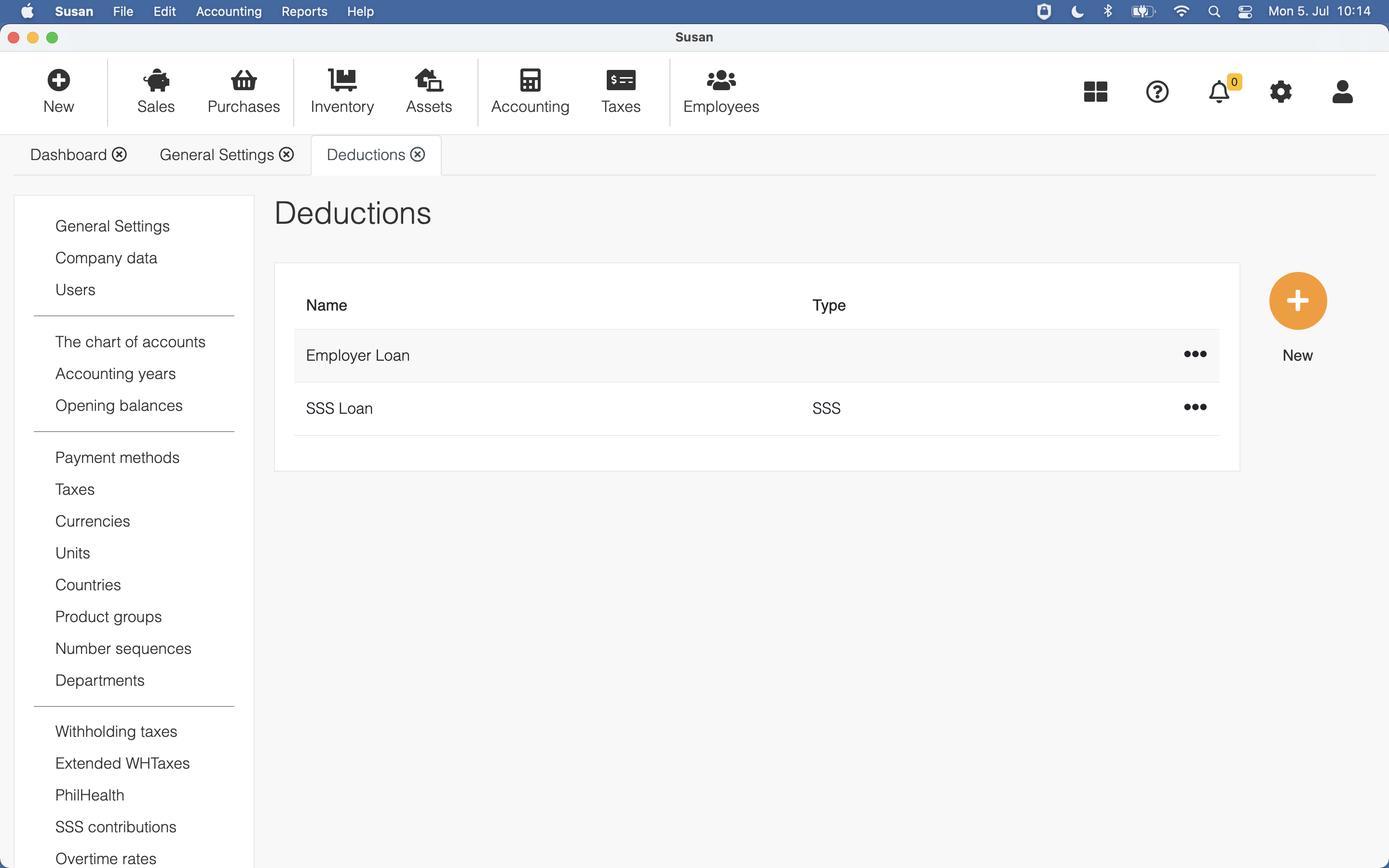

In Susan.one, you must create a deduction type before you can add payroll deduction. To review all deduction types, navigate to Settings > Deductions.

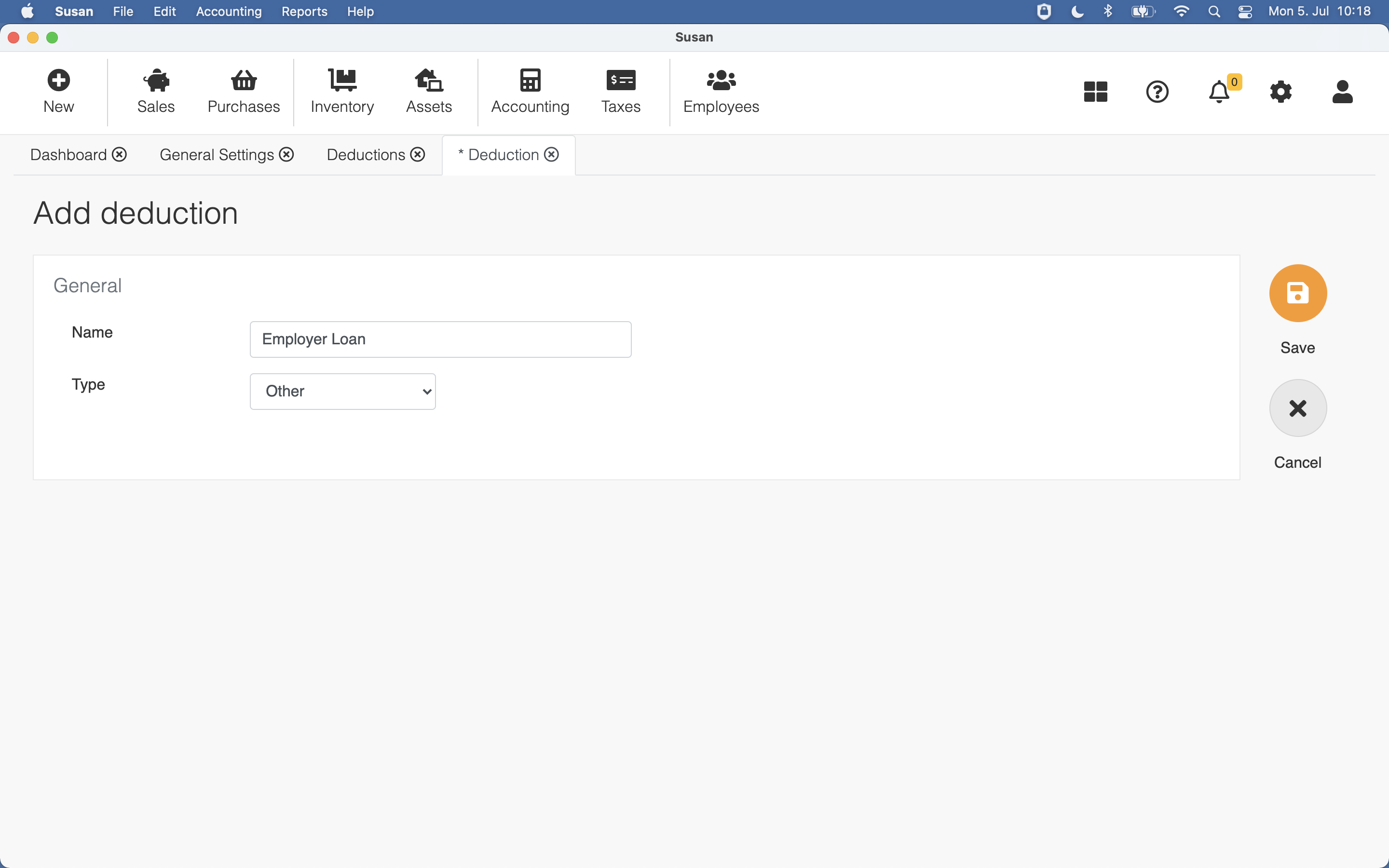

Adding deduction type

To add a deduction type, follow these steps:

- Open Deductions list view

- Click New

- Enter deduction name and select the deduction type

- Click Save

Selectable type parameter depends on your company’s country

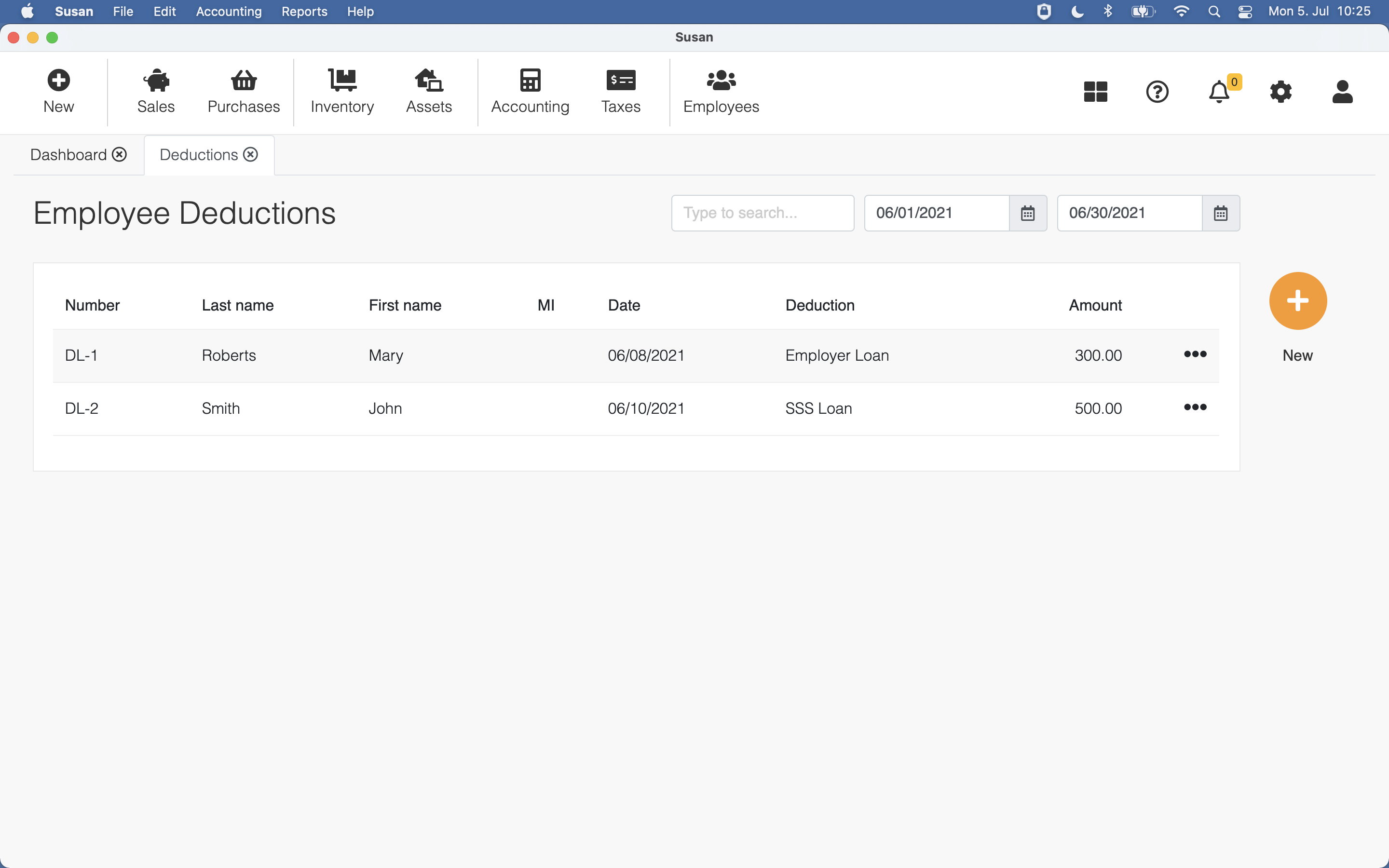

To review all payroll deductions, navigate to Employees > Deductions. Once there, you’ll see a list view of current month payroll deductions.

You can use the date filter to change the period of visible payroll deductions

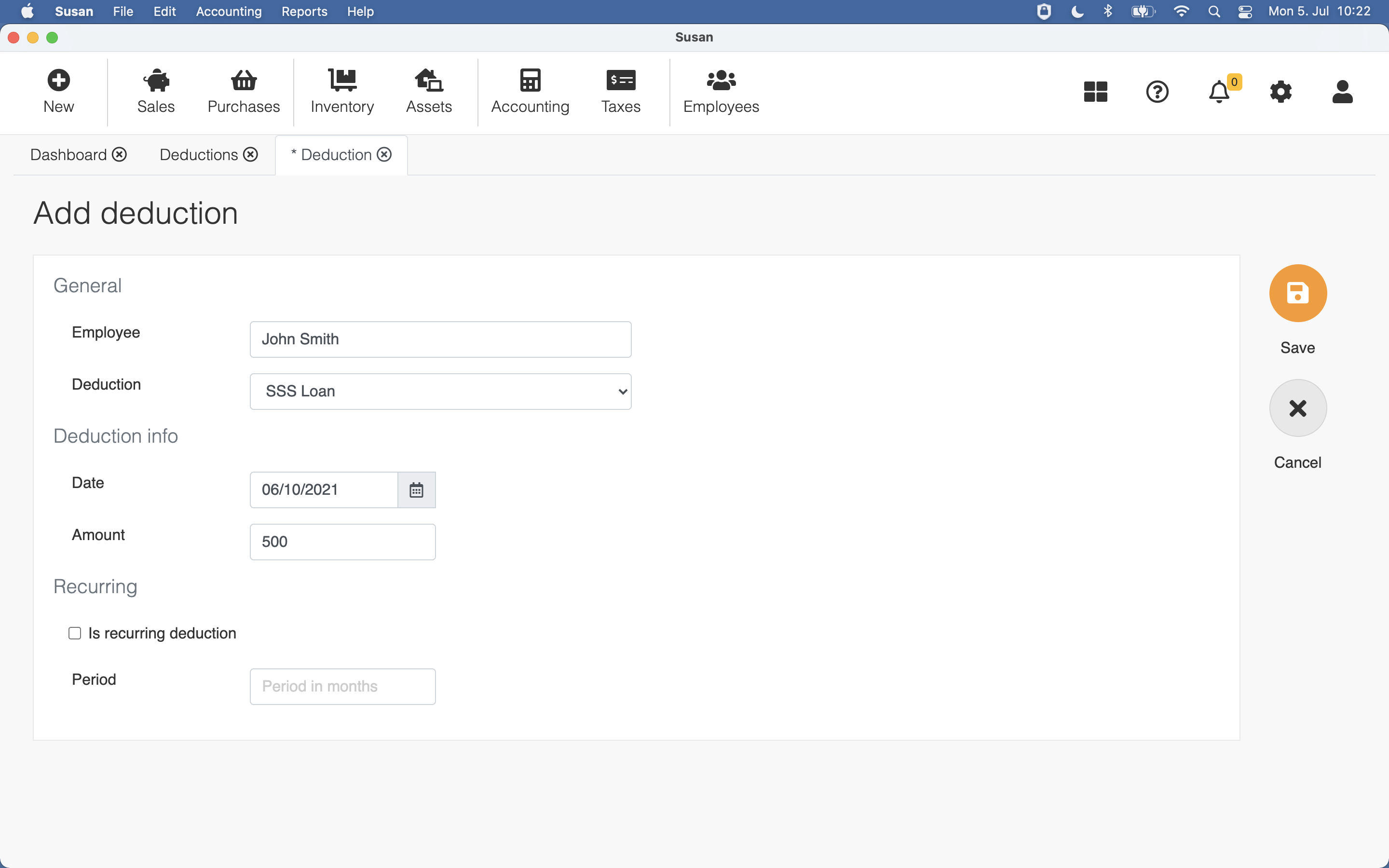

Adding payroll deduction

To add a payroll deduction, follow these steps:

- Open the employee deductions list

- Click New

- Fill the following fields:

- employee - select the employee

- deduction - select the deduction type

- date and amount - insert deduction date and amount

- Click Save

You can also create recurring deduction by defining the period length of the deduction.

Every deduction is numbered by the system with the prefix D. The L in the prefix means that the deduction is unsynced with the server and not available yet in other devices

Editing payroll deduction

To edit a payroll deduction, follow these steps:

- Open the employee deductions list and click on the deduction

- Change the deduction values

- Click Save

Deduction used in the payroll calculation, can’t be edited

Deleting payroll deduction

To delete the payroll deduction, follow these steps:

- Open the employee deductions list and click on the deduction

- Click Delete

- Click Confirm on the confirmation dialog

Deduction used in the payroll calculation, can’t be deleted

In case, when the deduction to be deleted was recurring deduction, all repetitions are also deleted.

Deductions report

Please take a look at the deductions report