Payroll calculation

Overview

- Payroll preparation

- Payroll confirmation

- Payroll view

- Printing payslips

- Payroll unconfirmation

- 13th Month Pay (Philippines)

- Reports

Payroll calculation in Susan.one is country-based, but the base concept is the same everywhere.

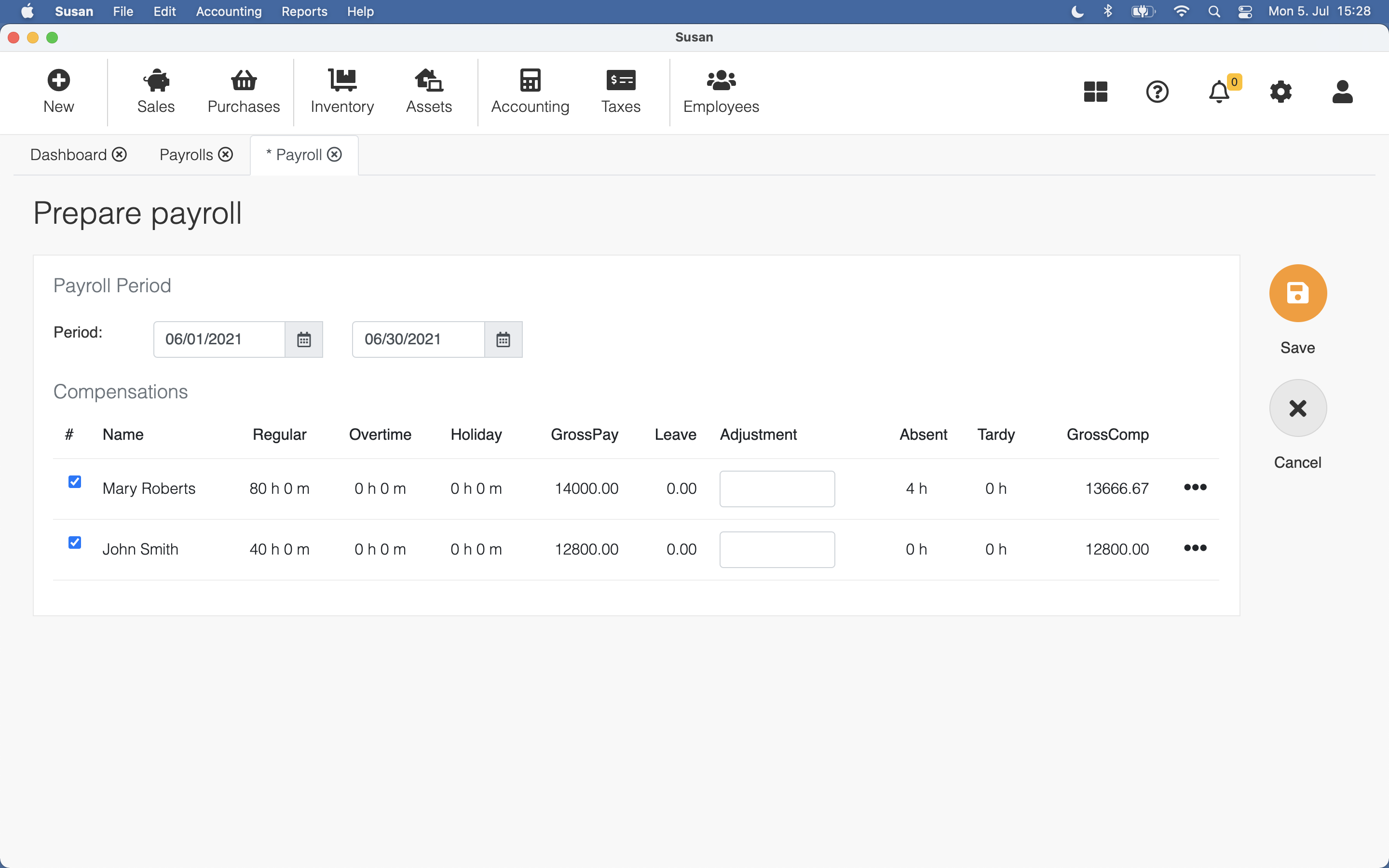

Payroll preparation

For payroll preparation, follow these steps:

- Open the payroll list from Employees > Payroll

- Click Prepare

- Select the payroll period

- Click Save

Susan.one will provide payroll data for the selected period, where you can also make manual adjustments if needed.

To exclude the employee from current payroll, uncheck the activity entry for the employee’s name

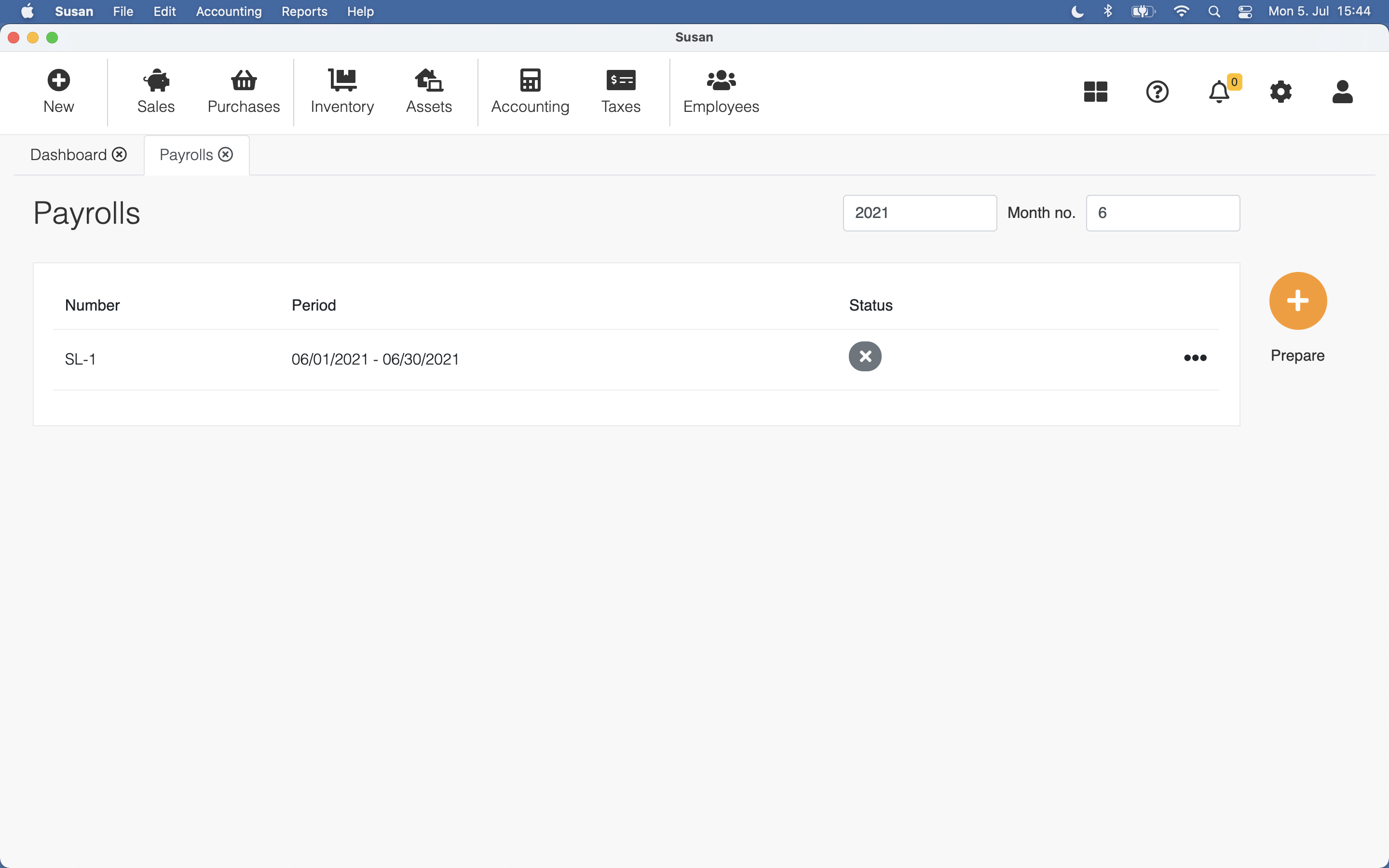

Payroll confirmation

For payroll confirmation, follow these steps:

- Open the payroll list from Employees > Payroll

- Set the desired month number and year

- Susan.one will display all payroll in current month (prepared and confirmed)

- Click on the unconfirmed payroll

- Click Confirm

All the time activities, absences, deductions and de minimis benefits included in payroll will be locked for editing

Every payroll is numbered by the system with the prefix S. The L in the prefix means that the payroll is unsynced with the server and not available yet in other devices

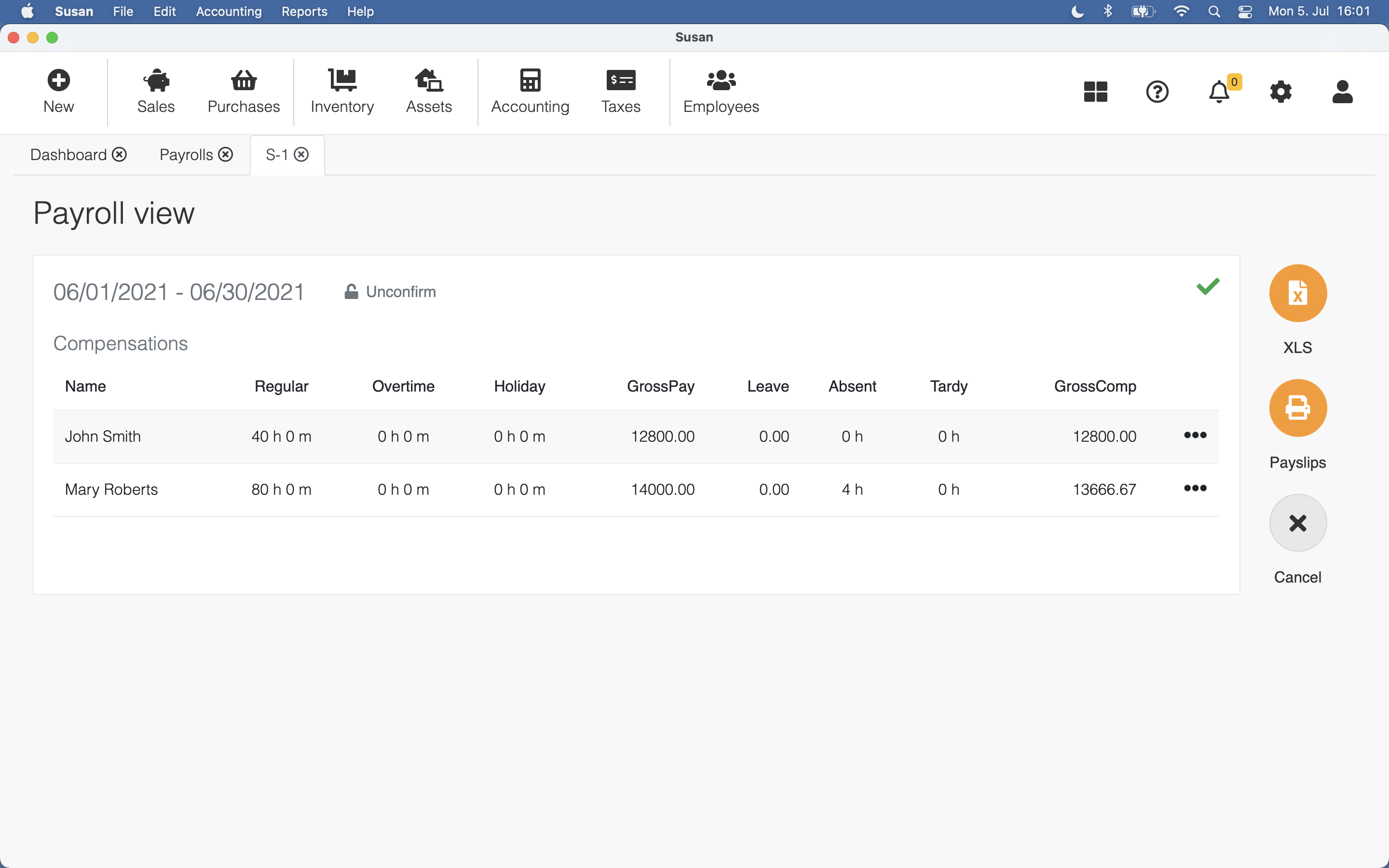

Payroll view

For payroll view, follow these steps:

- Open the payroll list from Employees > Payroll

- Set the desired month number and year

- Susan will display all payroll in current month (prepared and confirmed)

- Click on the confirmed payroll

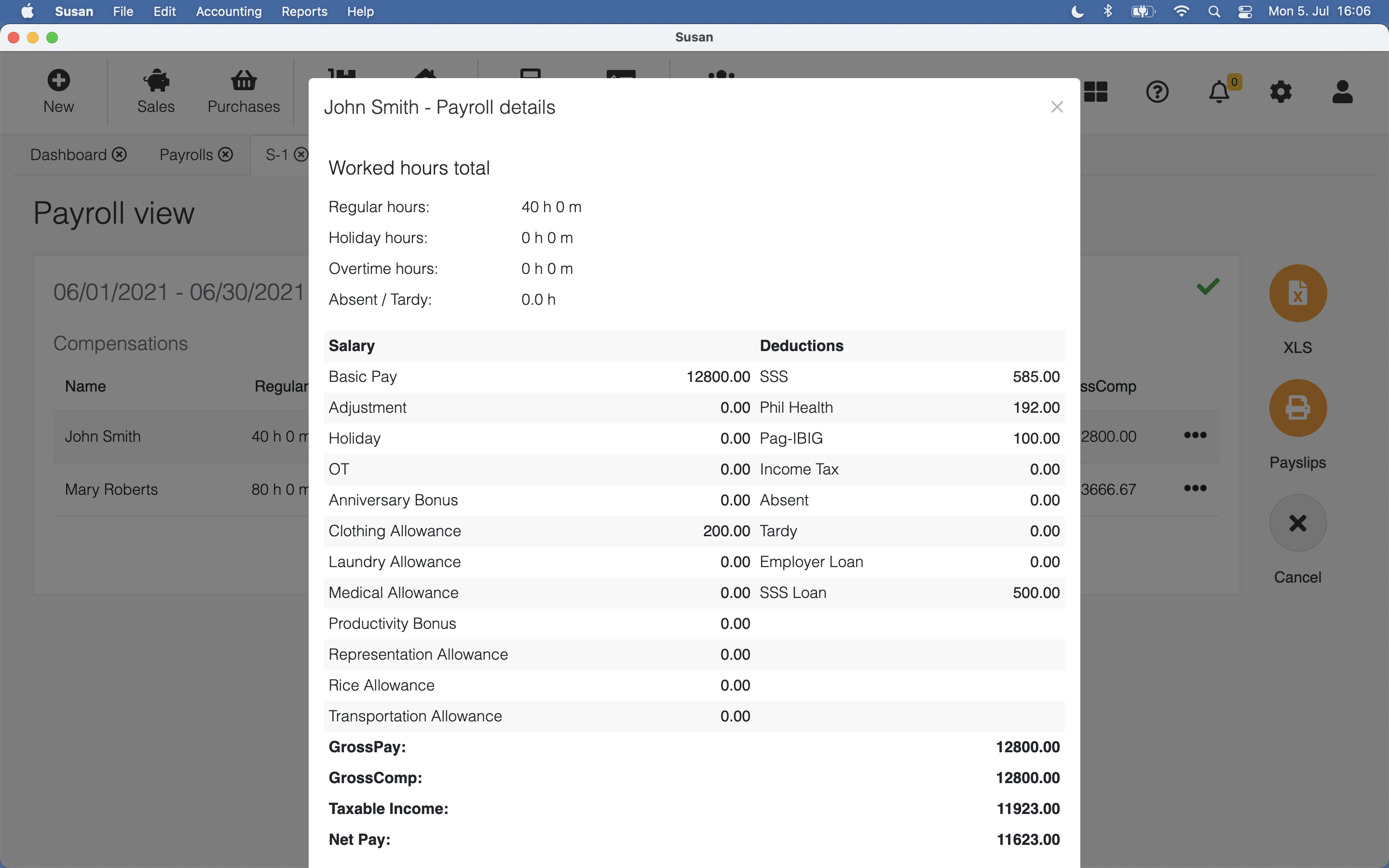

You can also get a full detailed view for each employee’s payroll by clicking Details in the end of the row.

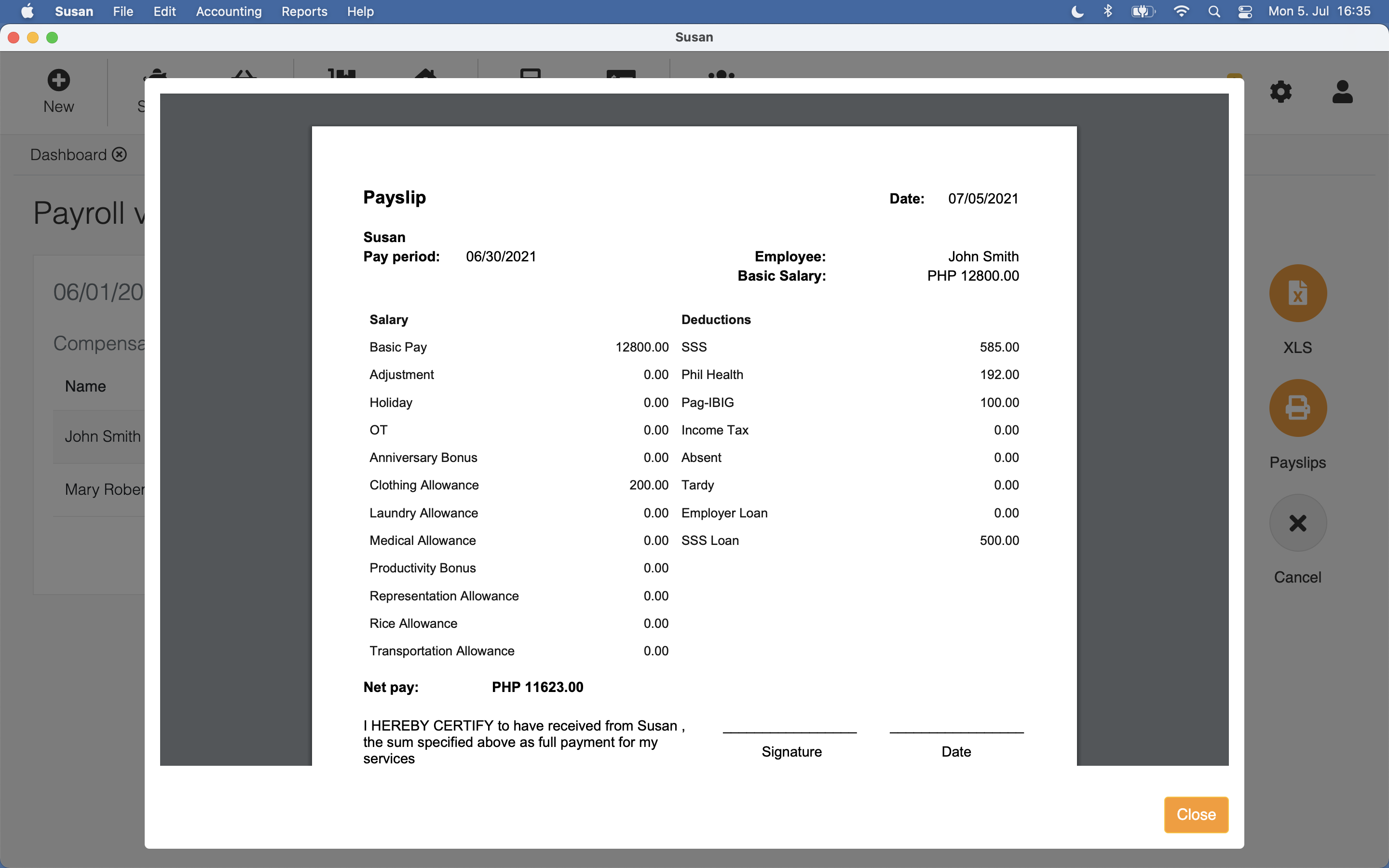

Printing payslips

For printing payslips, follow these steps:

- Click Payslips on confirmed payroll view

- Payslips print preview will be opened

- Download payslips in PDF file format or print them all at once

Payroll unconfirmation

If you need to re-calculate the payroll in case of added or changed data, you can un-confirm the payroll. For un-confirming payroll, follow these steps:

- Open the confirmed payroll

- Click Unconfirm

- Click Confirm on confirmation dialog

- All time activities, absences, deductions and de minimis benefits are now unlocked for payroll re-calculation.

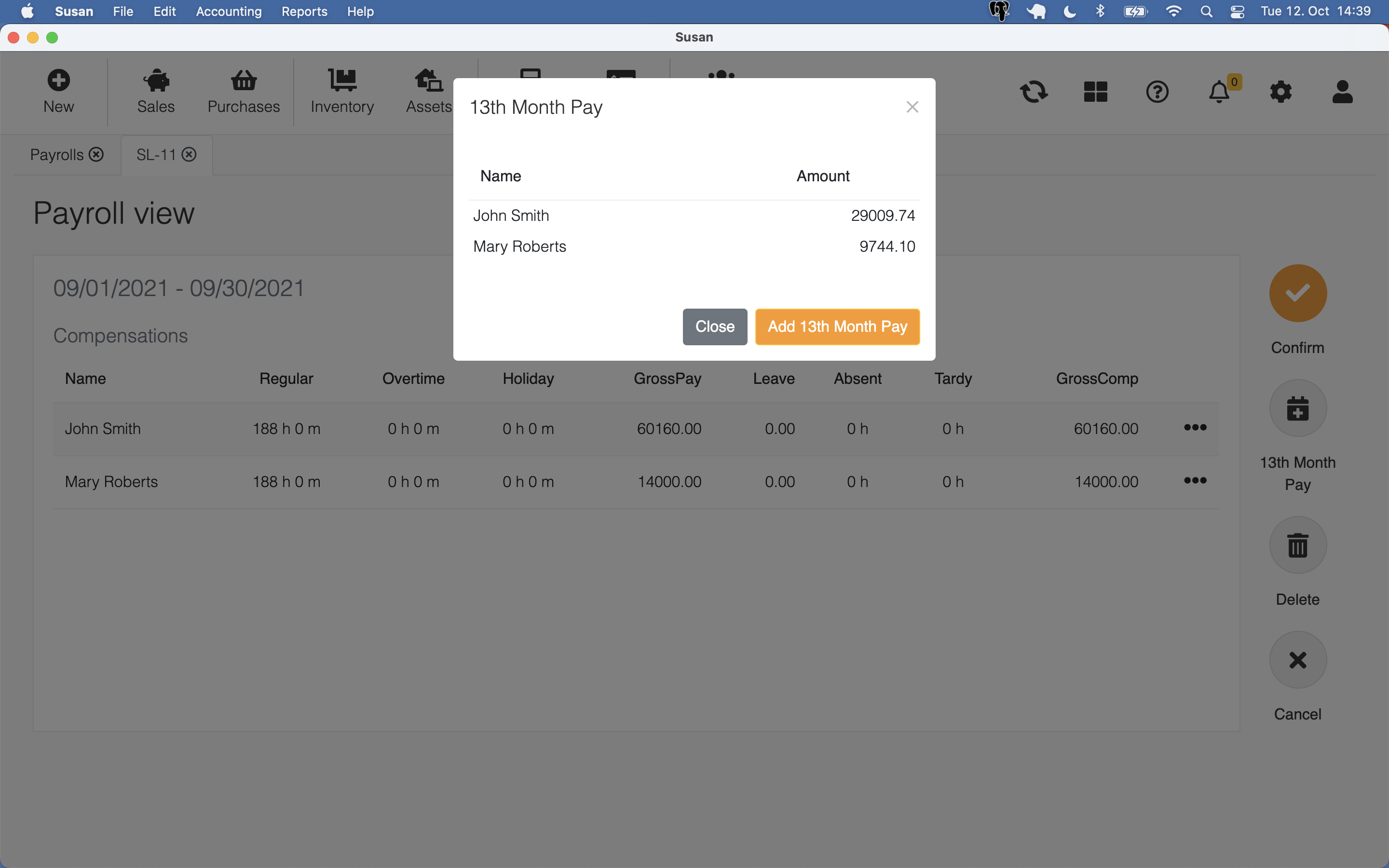

13th Month Pay (Philippines)

Under Presidential Decree No. 851, employers from the private sector in the Philippines are required to pay their rank-and-file employees a Thirteenth 13th Month Pay not later than December 24 every year. The 13th month pay is equivalent to one twelfth (1/12) of an employee’s basic annual salary.

Computation of the 13th month pay primarily consists of the total basic monthly salary of an employee for the whole year, divided by twelve (12) months. Those who have worked for less than a year, however, are only entitled to receive the amount due to them on the number of months they were employed.

Susan is computing 13th-month pay automatically and allows to include this whatever payroll. To do this, follow these steps:

- Prepare the payroll

- Click 13th Month Pay on payroll view

- Susan will display current 13th Month Pay amounts

- Click Add 13th Month Pay

Now, 13th month pay is included in payroll and also displayed on payslips.

To remove the 13th month pay from payroll, click on the 13th Month Pay button again and then click Remove 13th Month Pay.

Reports

Following reports are related with payroll: