Journal Entries

Overview

- Creating a Journal Entry

- Confirming Journal Entry

- Deleting Journal Entry

- Disconfirming Journal Entry

- Making a copy of the Journal Entry

- Examples of Journal Entry

A journal entry, also referred to as an accounting entry, records a business transaction in the accounting system for an organization. In Susan.one, journal entries are made by utilizing the double-entry bookkeeping system.

The double-entry accounting method requires every transaction to be recorded in at least two accounts and the debit and credit of the entry must be equal.

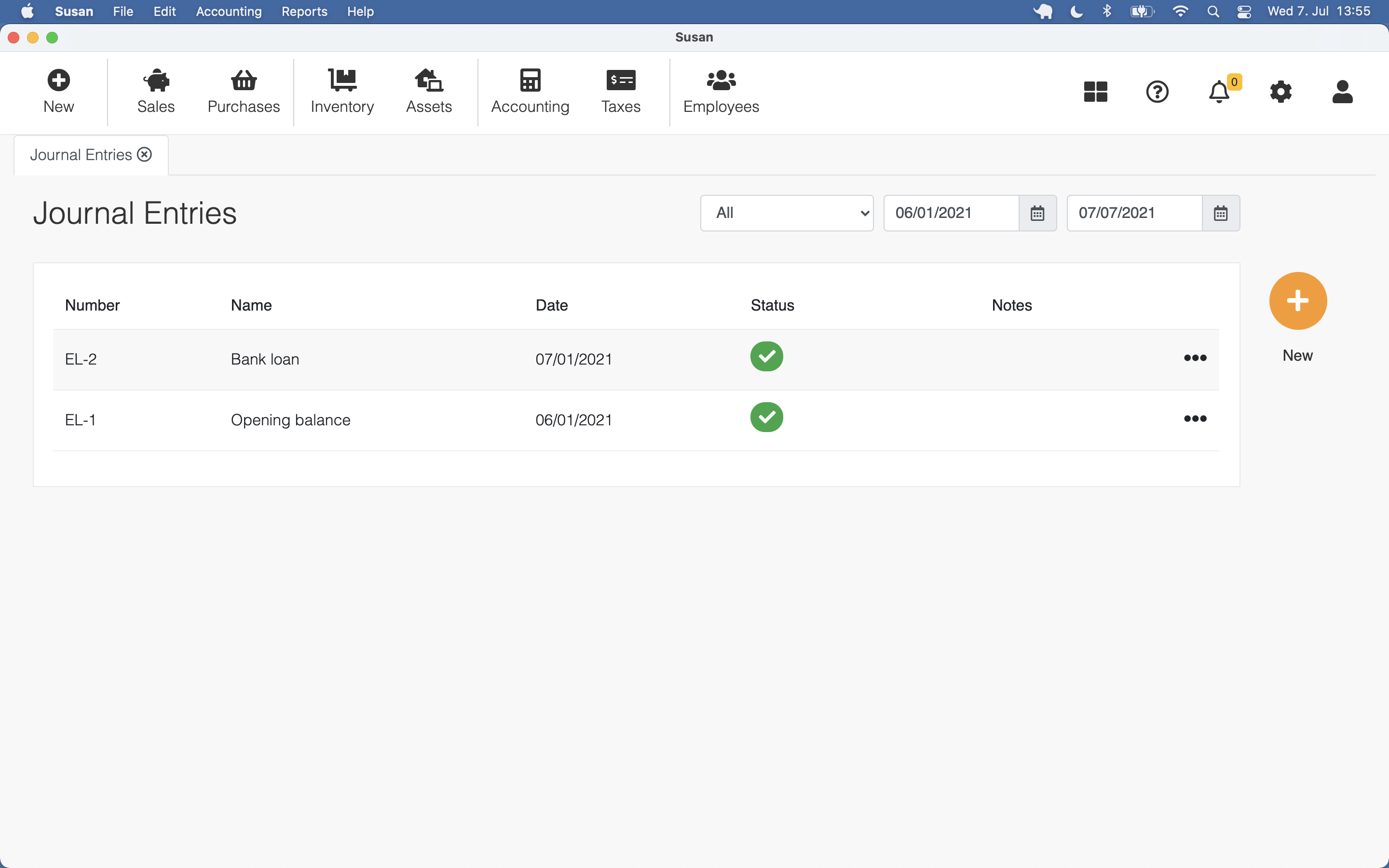

To review journal entries, navigate to Accounting > Journal Entries. Once there, you’ll see a list view of the current month journal entries.

You can use the date filter to change the period of visible journal entries

Creating a Journal Entry

There are many operations in Susan.one, that can lead to the creation of a journal entry automatically. However, sometimes it is necessary to create a custom journal entry.

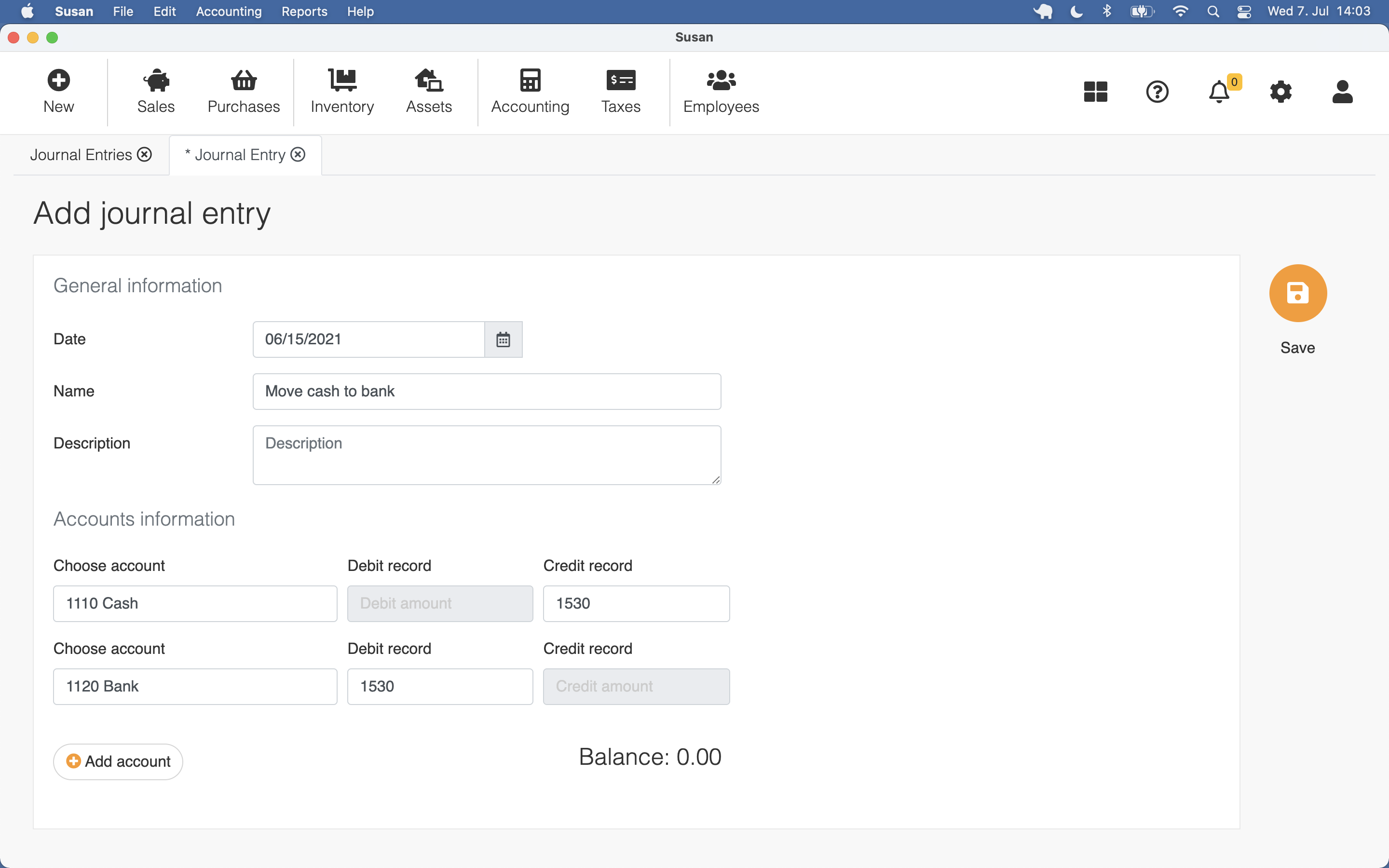

To add a journal entry, follow these steps:

- Open the journal entries list

- Click New

- Fill the following fields:

- date - entry date

- name - some name to the entry

- add accounts debit and credit values

- Click Save

You can use as many accounts as needed on the entry as far as the debit and credit amounts are balanced.

Every journal entry is numbered by the system with the prefix E. The L in the prefix means that the journal entry is unsynced with the server and not available yet in other devices

Confirming Journal Entry

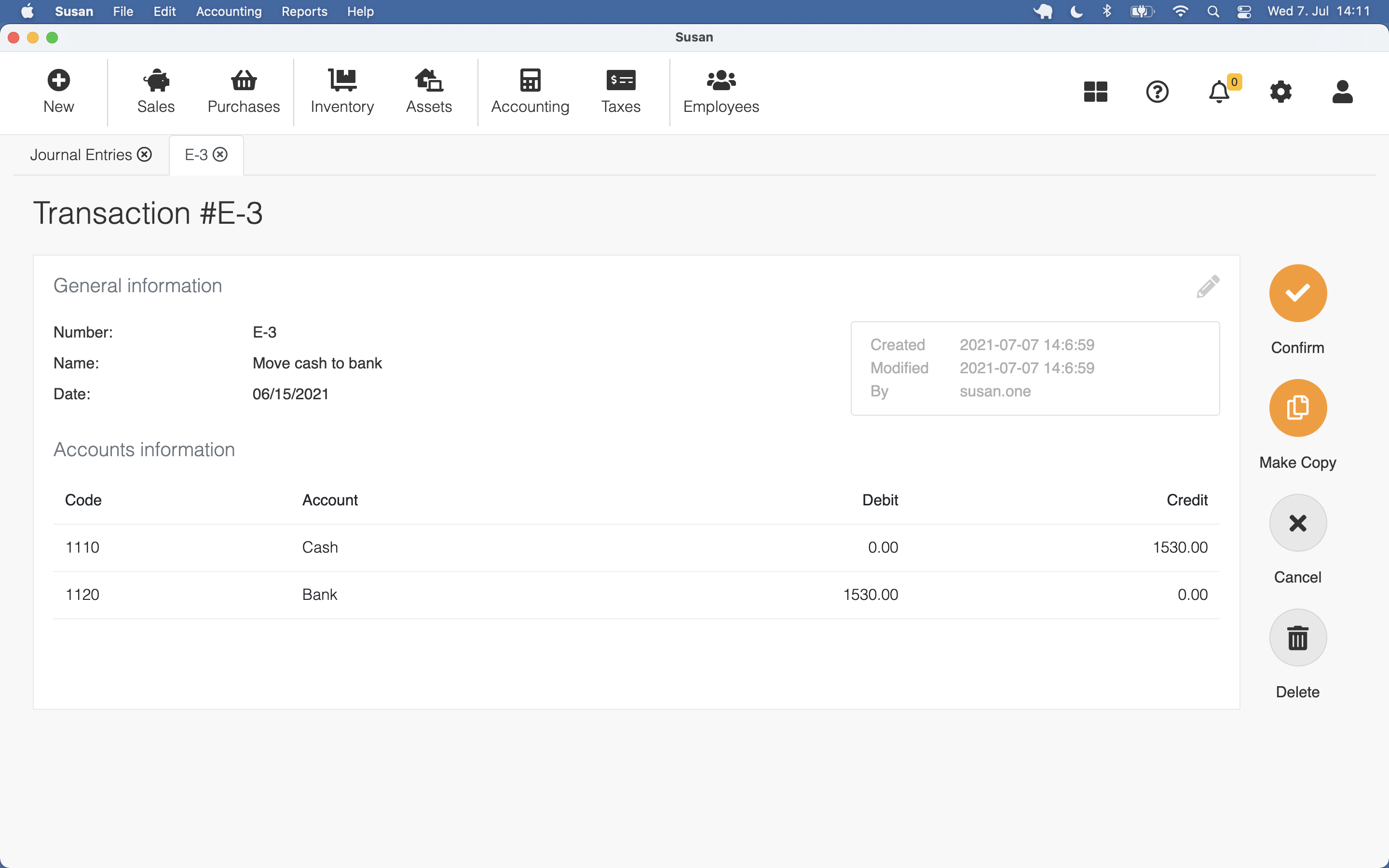

The created journal entry is in draft status and needs to be confirmed before it is available in the ledger.

To confirm the journal entry, follow these steps:

- Open the journal entries list and click on the entry

- Click Confirm

- Click Confirm on confirming dialog

You can see information, who and when created or modified this entry before confirmation

Deleting Journal Entry

Journal entries in draft status can be deleted. To delete the journal entry, follow these steps:

- Open the journal entries list and click on the entry

- Click Delete

- Click Confirm on confirming dialog

Journal entries in draft status can be deleted

Disconfirming Journal Entry

When the journal entry is confirmed, you can disconfirm it when really needed. To disconfirm the journal entry, follow these steps:

- Open the journal entries list and click on the confirmed entry

- Click Unconfirm

- Click Confirm on confirmation dialog

Making a copy of the Journal Entry

Sometimes it is necessary to make a copy of an existing journal entry in order to use it as a basis for a new entry. To make a copy of the journal entry, follow these steps:

- Open the journal entries list and click on the entry

- Click Make Copy

- Modify the entry data as needed

- Click Save

Examples of Journal Entry

The following journal entry examples in accounting provide an understanding of the most common type of journal entries used by the business enterprises in their day to day financial transactions.

Sale

| Account | Debit | Credit |

|---|---|---|

| 1130 Accounts receivable | 120.00 | |

| 4100 Retail sale | 100.00 | |

| 2130 Taxes payable | 20.00 | |

| Total | 120.00 | 120.00 |

Accounts recivable

| Account | Debit | Credit |

|---|---|---|

| 1110 Cash | 120.00 | |

| 1130 Accounts receivable | 120.00 | |

| Total | 120.00 | 120.00 |

Purchase

| Account | Debit | Credit |

|---|---|---|

| 5200 Office Expense | 100.00 | |

| 2130 Taxes payable | 20.00 | |

| 2120 Accounts payable | 120.00 | |

| Total | 120.00 | 120.00 |

Purchase fixed assets

| Account | Debit | Credit |

|---|---|---|

| 1353 Machinery and equipment | 1000.00 | |

| 2130 Taxes payable | 200.00 | |

| 2120 Accounts payable | 1200.00 | |

| Total | 1200.00 | 1200.00 |

Accounts payable

| Account | Debit | Credit |

|---|---|---|

| 2120 Accounts payable | 120.00 | |

| 1110 Cash | 120.00 | |

| Total | 120.00 | 120.00 |

Cash receipts

| Account | Debit | Credit |

|---|---|---|

| 4100 Retail sale | 100.00 | |

| 2130 Taxes payable | 20.00 | |

| 1110 Cash | 120.00 | |

| Total | 120.00 | 120.00 |

Amortization

| Account | Debit | Credit |

|---|---|---|

| 5400 Depreciation Expense | 100.00 | |

| 1360 Deprecations of tangable assets | 100.00 | |

| Total | 100.00 | 100.00 |

Payroll

After payroll calculation

| Account | Debit | Credit |

|---|---|---|

| 5700 Salaries and Wages Expense | 1000.00 | |

| 2150 Wages payable | 1000.00 | |

| Total | 1000.00 | 1000.00 |

Tax calculation

| Account | Debit | Credit |

|---|---|---|

| 5800 Payroll Tax Expense | 300.00 | |

| 2130 Taxes payable | 300.00 | |

| Total | 300.00 | 300.00 |

Payment of wages

| Account | Debit | Credit |

|---|---|---|

| 2150 Wages payable | 1000.00 | |

| 1120 Bank | 1000.00 | |

| Total | 1000.00 | 1000.00 |